Did you know that the dreamy islands of Phuket could hold a secret key to unbeatable mortgage rates? Florida might have sandy beaches, but its rates are far from idyllic. It's time to dig deeper into these regions and unlock some financial surprises!

Amidst the ongoing property booms, choosing between Florida and Phuket has never been more critical. With interest rates swaying like palm trees in the wind, property buyers are on a wild hunt for the best deals. Unravel the mystery behind these enticing mortgage offers today!

Shockingly, recent trends indicate that Phuket's exotic allure isn’t just skin deep. It offers incredible competitive rates that have drawn the attention of savvy investors across the globe. This revelation is sparking intense debates among financial experts. Florida's bustling real estate might be legendary, but some insiders argue that buyers are missing out on tropical gold. But that’s not even the wildest part…

Moreover, the average property tax rates in Florida are reportedly among the highest in the United States, quietly sneaking up on buyers unawares. Yet, Phuket's tax structure is refreshingly transparent and shockingly cost-effective, potentially saving clients thousands annually. But what lies beneath this surface could alter their perception of homebuying abroad forever...

Stay tuned, because as we delve deeper, you'll uncover intriguing advantages that Phuket possesses and why some believe Florida’s charm might be losing its shine. What happens next shocked even the experts…

If you thought Phuket's appeal was just its stunning ocean views, think again. A closer look reveals an attractive tax incentive for homebuyers. The Thai government's initiatives to entice foreign investments mean savvy homeowners can enjoy unheard-of low costs. These taxes typically hover under 1% annually, far less than Florida, making it a genuine contender. But the allure doesn’t stop there; unique investment opportunities await those willing to explore.

Indeed, purchasing a property in Phuket often includes a far lesser strain on your wallet compared to Florida's escalating real estate market. The vivid landscapes and beachfront properties are not just eye-candy — they come with the bonus of affordability. Although Florida holds history and nostalgia, the juxtaposition with Phuket’s economic appeal is compelling to even the most skeptical buyers.

In Phuket, access to expert guidance is merely a call away. Local agencies offer tailor-made services that crack the complexities of Thai property law. Florida, by contrast, presents layers of legislative tape that often baffle newcomers. This significant difference in bureaucracy might make some question their chosen investment destination. And if you're still on the fence about location choice, what you read next might change how you see this forever.

With every step further into this fascinating world of real estate, there's more to uncover. The race between Florida and Phuket is heating up, with Phuket gaining ground in unexpected ways. Could a shift in your perspective open doors you never considered? But there’s one more twist…

The marketplace in Phuket is rapidly transforming into a beacon for global investors. Unlike Florida’s often saturated real estate scene, Phuket promises untapped potential linked to an international clientele. It’s becoming a melting pot for business and leisure enthusiasts who are discovering this hidden gem, drawn by its lucrative potential and luxurious offerings.

This surge is sparking a vibrant community blend of ex-pats and locals, propelling a cosmopolitan vibe that many predict will enhance property values exponentially. With new infrastructure projects continually boosting accessibility and appeal, Phuket is proving it's not just a picturesque holiday spot but a promising investment hub.

Economic analysts forecast a steady growth in Phuket’s property value, predicted to yield handsome returns for current buyers. This isn’t just speculative hype — it’s backed by tangible trends and an emerging market strategy. Meanwhile, fresh visions for urban developments in Florida, although extensive, compete with existing congestion challenges.

What lies beyond these competitive housing markets? New policy shifts could redefine how title ownership works, enticing even more savvy investors into the fold. As the globe unbuttons its collar and glances toward Thai shores, discover what might forever change the property-buying rules you thought you knew.

In the realm of mortgages, hidden fees are the unwelcome surprise many would like to avoid. Phuket, intriguing in its simplicity, offers such transparency that it borders on revolutionary. With straightforward rates, buyers often find the end price magically aligns with original quotes, a relief contrasted with Florida’s sometimes opaque additional costs.

Yet, the world of mortgages is never static, and rates fluctuate with global tides. Economists emphasize a need for vigilance — understanding trends could save thousands over time. In Phuket, financial literacy tools are conveniently accessible, promoting well-informed decisions while enjoying local cultural flair.

Interestingly, seasoned brokers in Phuket unlock local lending advantages and forge connections with international banks, showcasing a global financial dialogue. Florida maintains its dominance with developed credit systems and solid financial histories, but the mysterious ease in Phuket tempts even the skeptical.

As mortgage offers evolve, the challenge lies in bridging the gap between what was once an unreachable dream and today's tangible possibilities. Could innovative strategies soon build a bridge over these contrasting financial waters, rewriting the future of property investments? What comes next could change everything you presumed about homeownership…

What drives the ever-changing mortgage rates in these desirable locations? It turns out the global economic landscape plays puppet master, with interest rates swaying under its whimsical rules. Florida, deeply embedded in the U.S economy, is sensitive to federal policy changes. In contrast, Phuket benefits from Asia’s dynamic shifts, often resulting in lower or more stable rates.

This disparity offers international buyers a position of power. Understanding how the global market impacts local conditions might clarify why seasoned investors are shifting focus towards Phuket. Meanwhile, Florida’s economy is navigating domestic challenges, adding to the unpredictability for property seekers.

The power of negotiation can't be overstated in these unique markets. In Phuket, cultural nuances and traditional bargaining can yield phenomenal financial benefits. Florida offers a straightforward approach, leaning heavily on consistent credit scoring and standardized processes. But what if the key to saving thousands was found in understanding these subtle differences?

As sea levels rise, it's not just the tides that are changing. Property value and security face new scrutiny. Balancing risk and reward may depend on uncovering truths hidden beneath dense legal texts and opaque financing terms. What happens next might just redefine property buying as we know it…

Location is king in real estate, and when it comes to pristine landscapes, Florida and Phuket don’t disappoint. In Florida, the sun-kissed coastlines remain captivating, but what's the trade-off? Population density increases competition and inflation. Not everyone relishes crowded beaches.

Phuket, on the contrary, revels in maintaining its serene beauty, strategically limiting over-commercialization. This charm, paired with low population stress, provides a more enjoyable lifestyle with fewer headaches over traffic and crowded spaces — offering peace homebuyers rarely find in Western regions.

Travel accessibility also shifts the decision-making scale. Phuket’s thriving international airport increases its desirability as a globally-connected haven. Yet, Florida’s extensive domestic flight networks make it an enticing U.S-based retreat. The competitive travel market points to evolving mobility — what could be next?

With eco-friendly initiatives gaining traction across the globe, both locations are stepping up. Explore how each aligns with green living trends, promising sustainability alongside stunning vistas. Consider if these strategic moves might tip your favor. Discover what's more under these surface decisions that could change home notions forever...

Diving deeper into the swirling tides of economic foresight, it’s apparent Florida’s stronghold on the property market is legendary. However, experts suggest a renaissance on Thailand’s shores. With its monetary policies pivoting towards inclusivity, Phuket could hold the secret weapon for your financial future.

But how do these factors play into real-world applications? Shaped by diverse economic histories, each location harbors distinct fiscal paths. Florida, with its resilient infrastructure, presents a stable yet predictable landscape. Conversely, Phuket’s developing economy introduces unexpected twists with emerging opportunities for risk-tolerant leaders.

For those mindful of legacy-building, each region’s ability to adapt to economic downturns is a vital consideration. Diverse investment portfolios may embrace the unpredictability of Phuket or hedge bets with Florida's reliability. Could your next financial decision redefine your family's future? Explore scenarios you’ve never ventured before.

The revolution in mortgage approaches teems with potential undercurrents, but make no mistake — financial acumen is your anchor. Deciphering cryptic loan conditions might just hold the key to unprecedented success. What hidden treasure lies ahead in these complex landscapes? Hold on as pieces of the puzzle slowly unveil…

Safety in investments extends beyond borders, with factors like political stability and natural disasters playing critical roles. Florida is tested and true, with longstanding mechanisms in place for weather-related occurrences. Can the same be said for Phuket’s breathtaking but vulnerable terrain?

Despite the challenges, Thailand showcases commendable disaster resilience, with robust evacuation plans and community spirit. The calm after the storm in Phuket is not just poetic — it's a practiced reality. While Florida’s preparations are well-respected, Phuket’s response is quietly efficient.

Political climates also paint distinct pictures. Florida’s robust yet at times turbulent political landscape contrasts against Thailand’s steady approach, though its periodic uncertainties do require an investor’s keen monitoring eye. Yet, both locations symbolize resilient living when challenges arise.

How do perceptions of safety alter your investment strategies? Can understanding local measures against adversity provide peace of mind when diversifying portfolios? Find out if these insights could shape the contours of your next significant venture. The unexpected awaits in this cross-ocean saga.

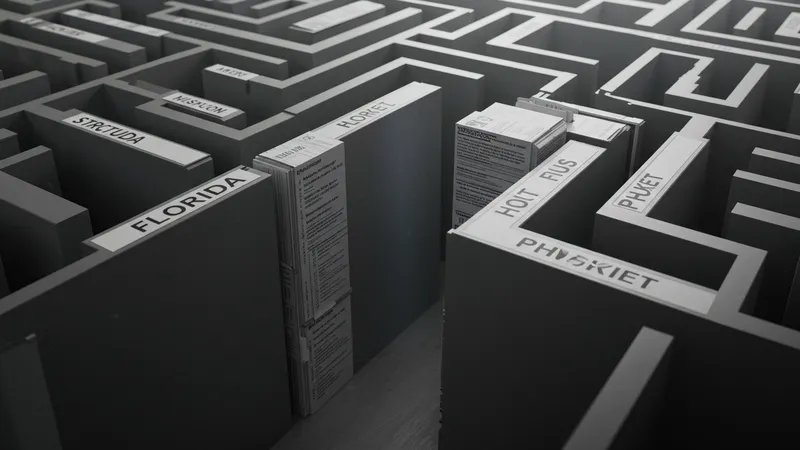

Legal frameworks present a maze of complexity that can bewilder even seasoned buyers. Florida's clear-cut property rights follow a systematic code, offering reassurance. However, it stands in contrast to Phuket's need for detailed research, as foreign ownership requires thorough comprehension and partnerships.

Despite initial obstacles, Thai property laws offer unique pathways to home acquisition, with leasehold arrangements making dreams feasible. Florida's processes, though straightforward, still necessitate careful oversight amidst evolving property regulations.

Hiring local legal support in Phuket allows navigation through intricate entry points. Lawyers adept in hospitality laws become allies, ensuring your venture aligns with local expectations. Meanwhile, Florida’s vast pool of real estate attorneys guides potential homeowners through myriad processes seamlessly.

Is the legal barrier a deterrent or an opportunity for extraordinary bargains? Explore the growing role of multicultural legal teams in breaking language barriers and bridging cultural gaps. Discover unexpected advantages in understanding legal nuances across seas. More insights reveal astonishing paths ahead…

Both Florida and Phuket boast unique economic growth drivers. Florida's tourism thrives symbiotically with its substantive industries, fortifying its market. Conversely, Thailand's burgeoning tech scene broadens Phuket's horizons beyond a sunlit paradise.

This growth extends into vital resources, with sectors experiencing rapid development and cross-border collaboration. Intersecting industries forge dynamic spaces for innovation, suggesting untapped opportunities for future-forward investors.

But could this growth be the beginning of a future powerhouse? Technology and tourism intertwine, ushering a new era for local economies. As these regions transform under the evolving global landscape, predicting which will dominate property outcomes becomes a venture rich with dividends.

Such growth raises critical questions. Is profit maximization competing with sustainability, or are there synergies yet to unfold? Stay engaged to grasp the groundbreaking potential of these breathtakingly evolving markets. With these discoveries, the destiny of your investment aspirations awaits...

For those on the quest for their tropical dream home, leveraging the right tools is crucial. Each regional market presents specific strategies to capitalize on opportunities, and buyers must remain informed and adaptive.

In Phuket, cultural awareness can secure negotiations. Relationships and timing become strategic weapons that can make deals sweeter. Florida entails fine-tuning with long-term financial planning, utilizing all data-driven market insights available.

Tech-savvy buyers can tap into integrated platforms offering real-time updates and targeted analytics, granting competitive edges. Bridging technology with intellect primes buyers for discovering unforeseen pros of these alluring destinations.

Skillful navigation involves more than tools — it’s about foresight. As unpredictable as these two regions may be, integrating traditional and modern strategies ensures a tailored approach to investment success. Prepare for a captivating end to this epic experience…

In the competition of picturesque locations, Florida’s charm battles Phuket’s hospitality hues. They both present incredible benefits, each with a distinct allure yet facing unavoidable challenges. In this tumultuous journey, the rewards await those daring enough to capture the essence of each and looking beyond the obvious.

Ultimately, the decision hinges on aligning factors with personal objectives. Whether the magnetic pull of Phuket's exotic landscapes or the reliability of Florida's classic allure tempts you most, both offer potential paths to prosperity.

The narrative of cross-continent investment is fraught with exciting opportunities and intellectual awakenings. As eyes gaze upon these titans of property potential, the key takeaway is clear: every destination promises a piece of paradise, but discerning buyers must write their own chapters.

In conclusion, this tale of two shores offers insights that stretch beyond the horizon. Contemplate their ripples on the global stage and venture boldly into a world rich with opportunities. Where will your choice lead you next? Discover a world that awaits with a twist...